capital gains tax services

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Just like income tax youll pay a tiered tax rate on your capital gains.

Personal Income Tax Services Nyle G Taylor Cpa

If you sell collectibles art coins etc your capital gains tax rate is a maximum of 28.

. Capital gains tax rates on most assets held for less than a year are taxed. The Fiji Revenue Customs Service is the major funder of the National Budget. How you report and pay your Capital Gains Tax depends whether you sold.

2021 capital gains tax calculator. One of the simplest strategies if possible is to hold on to your assets longer. Short-term capital gain tax rates.

Capital gains taxes on. For the 20222023 tax year these tax rates are 10 18 for residential property for your entire capital gain if your overall annual income is below 50270. Use your payment reference when you pay.

The capital gains tax is often low or nonexistent for those with an adjusted gross. If your taxable gains come from selling qualified small business stock section 1202. See reviews photos directions phone numbers and more for Capital Gains Tax locations in Piscataway NJ.

For example a single person with a total short-term capital gain of 15000 would. If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately. You must report by 31 December in the tax year after you made your gain.

20 28 for residential property. Long-term capital gains are taxed at a rate that varies with the investors marginal tax rate. Weve got all the 2021 and 2022 capital gains tax rates in one.

In 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. You must report all 1099-B transactions on Schedule D Form 1040 Capital Gains and Losses and you may need to use Form 8949 Sales and Other Dispositions of Capital. Apart from our primary mandate FRCS continues to partner and support other government.

Industrys ideal tax set-up in the UK could change as politicians re-examine the concept of capital gains. They are subject to ordinary income tax rates meaning theyre. Avoid paying the short-term capital gains tax rate by waiting longer than a year.

Something else thats increased in value. Using the online tax payment service. What you need to do.

Its the gain you make thats taxed not the. Short-term capital gains are gains apply to assets or property you held for one year or less. UK business economy.

A residential property in the UK on or after 6 April 2020. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. 2022 federal capital gains tax rates.

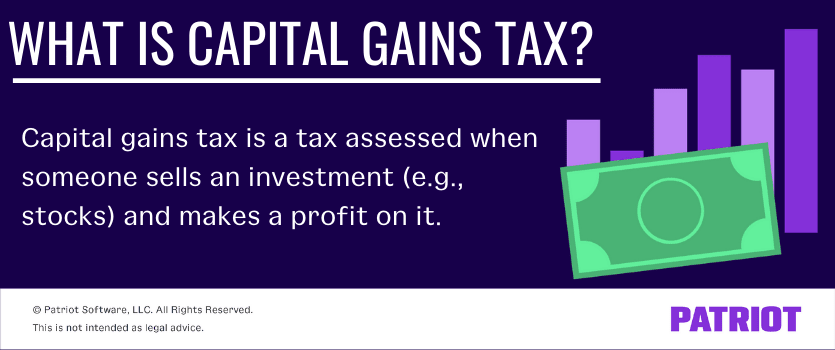

2022 capital gains tax rates. Through online banking or cheque. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

5 Things You Should Know About Capital Gains Tax Turbotax Tax Tips Videos

What Is Capital Gains Tax Business Owner S Guide

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Crypto Capital Gains And Tax Rates 2022

New Capital Gains Tax Increases And Home Sales Osprey Accounting Services

2022 2023 Capital Gains Tax Rates Calculator Nerdwallet

Capital Gains Tax Solutions Tax Services 915 Highland Point Dr Roseville Ca Phone Number Yelp

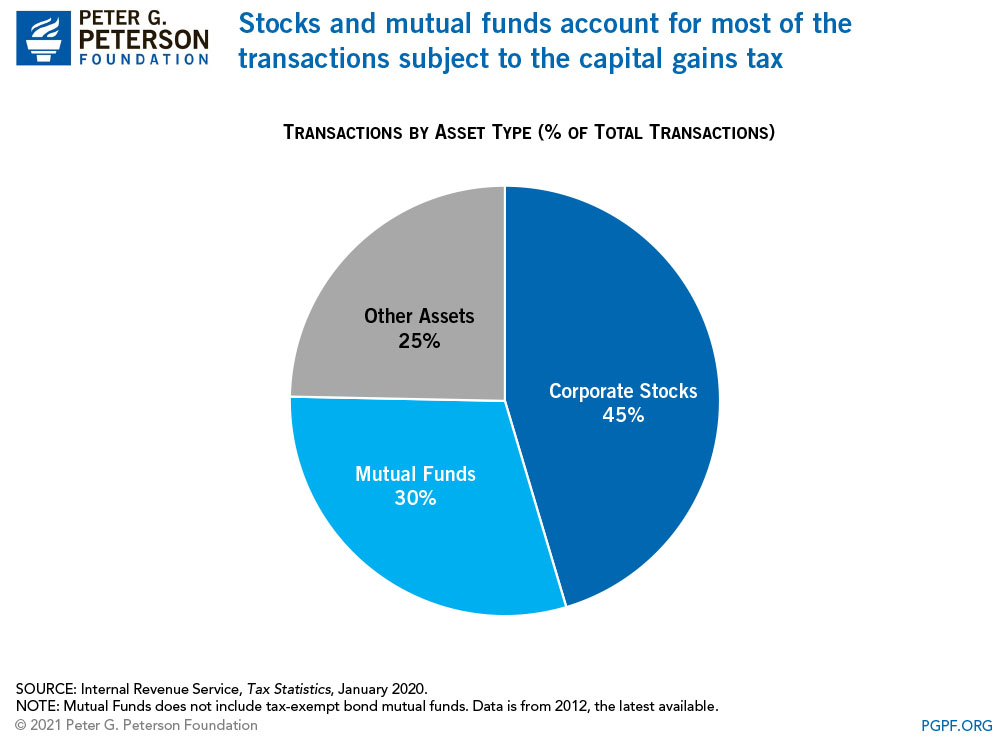

How Could Changing Capital Gains Taxes Raise More Revenue

What Is Capital Gains Tax Business Owner S Guide

Capital Gains Tax On Selling A Business In California

Capital Gains Tax In The United States Wikipedia

Capital Gains Taxation Bracket Rates 2019 Strategy Guide

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

/CapitalGainsTax-e7789cc983e14474abf5d3f345ff6c8a.jpg)